Customer Complaints

Customer Complaint Handling

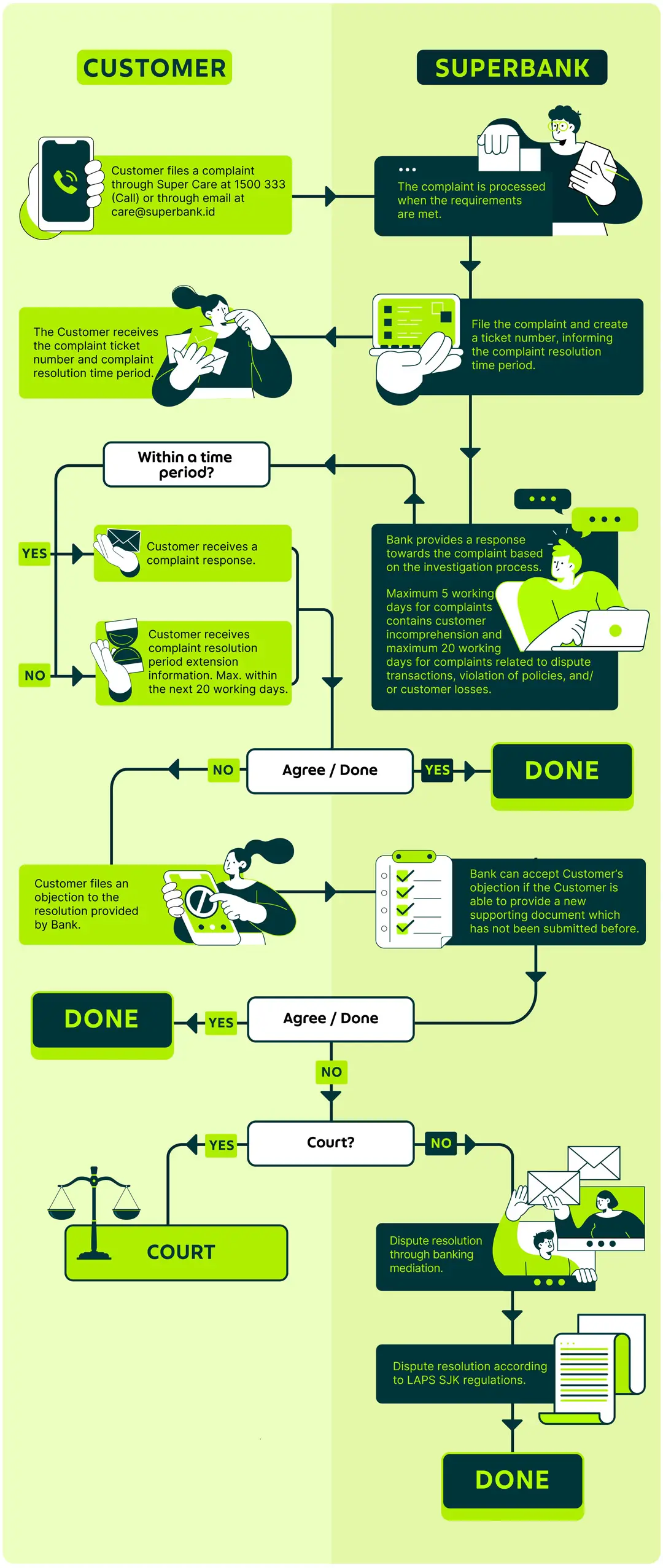

Customers can file complaints to Super Care verbally through call at 1500 333 or in writing through email at care@superbank.id.

Complaint Handling Period

- Verbal

Verbal complaints are handled and resolved within 5 (five) working days starting from the date the complaint is received with complete supporting documents. - Written

- Written complaints that contain elements of customer incomprehension are handled and resolved within 5 (five) working days. Elements of customer incomprehension include:

- Inquiry related to products and/or services provided by the Bank which is used by the customer;

- Customer complaint procedure to the Bank; and/or

- Other information related to products and/or services which customers need to know

- Meanwhile, complaints related to dispute, violation of policies, or customer losses are handled and resolved within 20 (twenty) working days starting from the date the complaint is received with complete supporting documents. The complaint resolution period may be extended by a maximum of 20 working days, if:

- During the complaint handling process we encounter obstacles, such as: different locations between where the incident occurred and where the complaint was filed;

- The complaint is complex and therefore needs in-depth research and investigation into the Bank’s and other parties’ documents; and/or

- There are matters beyond the control of the Bank, such as involvement of third parties who are in partnership with the Bank

- Written complaints that contain elements of customer incomprehension are handled and resolved within 5 (five) working days. Elements of customer incomprehension include:

In the event that the Bank requires supporting documents for complaints submitted verbally, the Bank may ask the Customer to submit a written complaint along with the complete supporting documents and submit them by email. In this case, the complaint resolution period will follow as stated in point (2) above.

The Bank will proceed to handle the complaint when the Customer has provided the complete supporting documents, such as:

- Customer full name

- Active phone number of the customer

- Chronology of complaints

- Other supporting data or documents, such as proof of transactions, proof of screen displays, and other relevant documents;

Please note that the Bank never asks the Customer to submit or notify the access code or security code owned by the Customer to access the account and/or make transactions. Customers must always maintain the confidentiality of any access code for the customer's account and to always contact the Bank's official contact channel when submitting complaints.

Complaints will be registered by the Bank and the complaint resolution period will start when the customer submit the complete information and relevant supporting documents.

If the Customer wishes to raise a dispute on the complaint resolution, the Customer may:

- File another complaint by attaching a new relevant document that has not been submitted before; or

- Submit dispute resolution both in court and outside the court, including through institutions in accordance with OJK regulations.

The Financial Services Sector Alternative Dispute Resolution Institution (LAPS SJK)

- Address: Wisma Mulia 2 Lt. 16, Jl. Gatot Subroto No.42, South Jakarta 12710

- Telephone: 021-29600292

- E-mail: lapssjk@gmail.com