Main Savings Account

Opening an account is as easy as that!

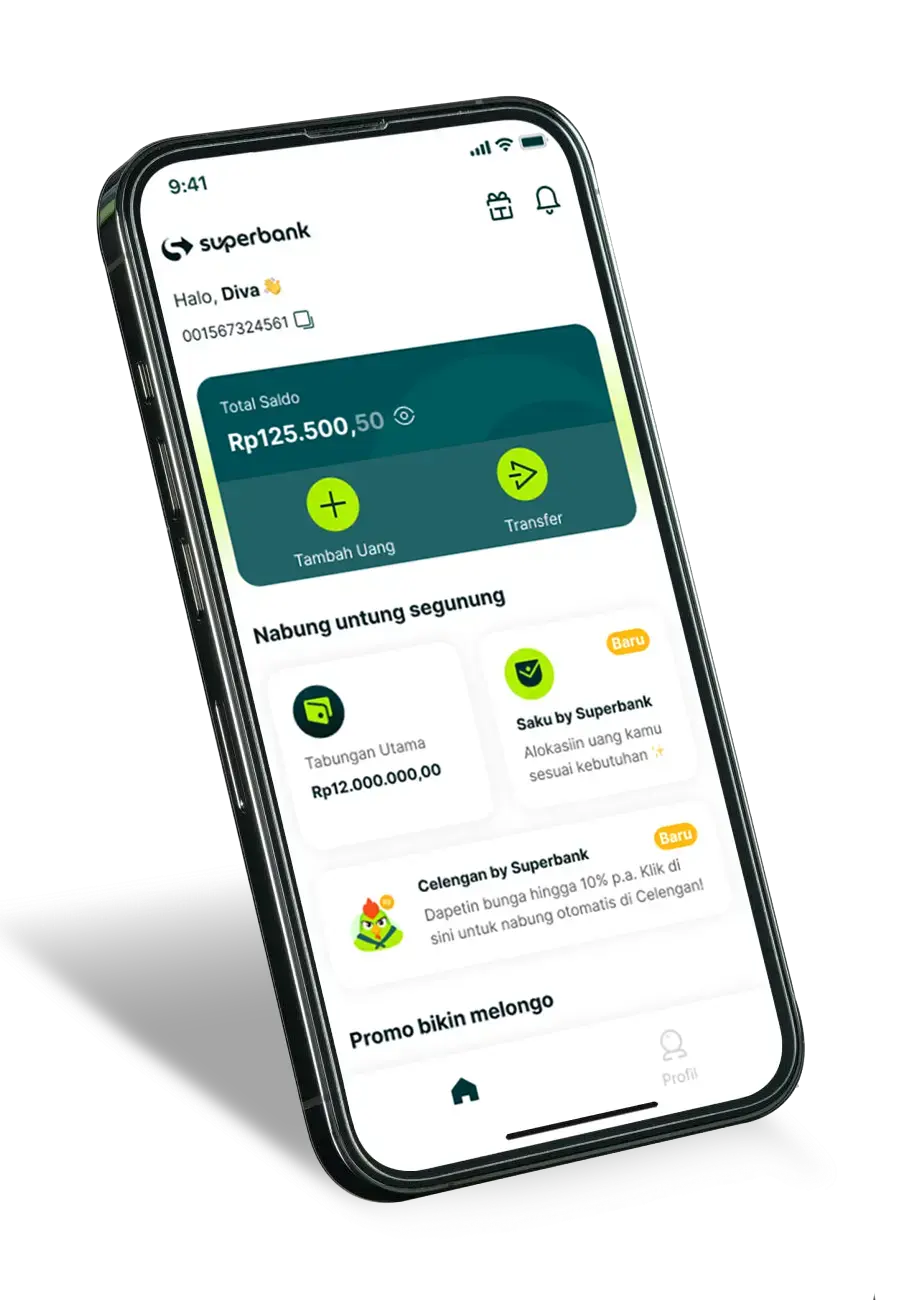

Enjoy all the features of Superbank in the

Main Savings Account.

The Main Savings Account is your primary account.

It is automatically created when you successfully register as a

Superbank customer for the first time.

Use Superbank as you please!

No administration fees, no initial deposits, and no minimum balance. You can have an account with Superbank right away.

Open an account as easy as that

Simply use the Superbank app to complete your personal information and verification, your account will be activated immediately!

Your trusted account

Enjoy all the features of Superbank with the Main Savings Account.

Let's find out how to open a Main Savings account!

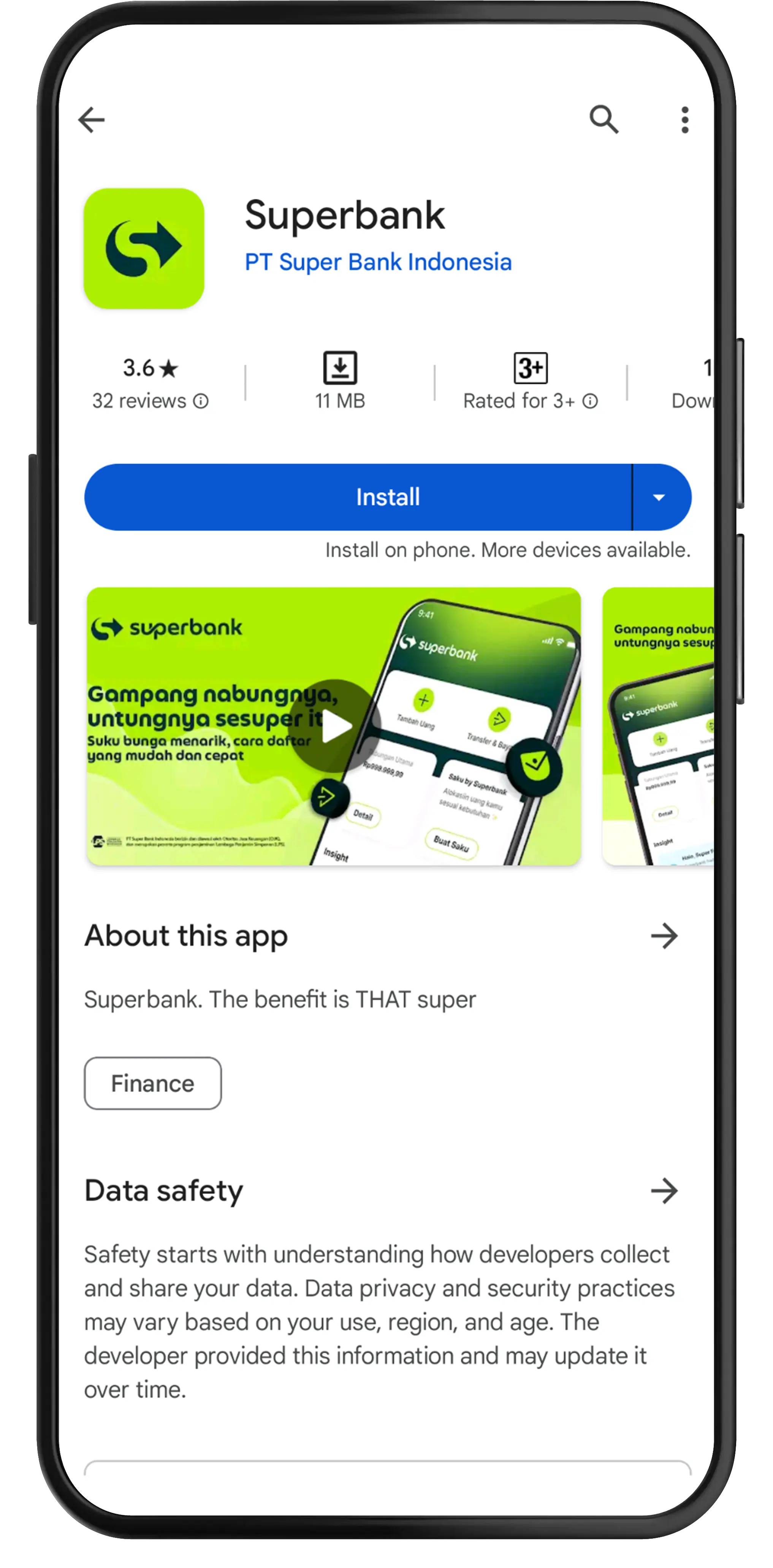

Download the Superbank app

You can download it from the Google Play Store or Apple App Store.

Prepare your E-KTP!

You can open an account with just your E-KTP!

Fill in the E-Form

Complete your personal information and follow the provided instructions.

Verify data and prepare a well-lit location!

Prepare a well-lit location and background for your selfie. Remove your mask, hat, and glasses to enhance the success of the facial verification process.

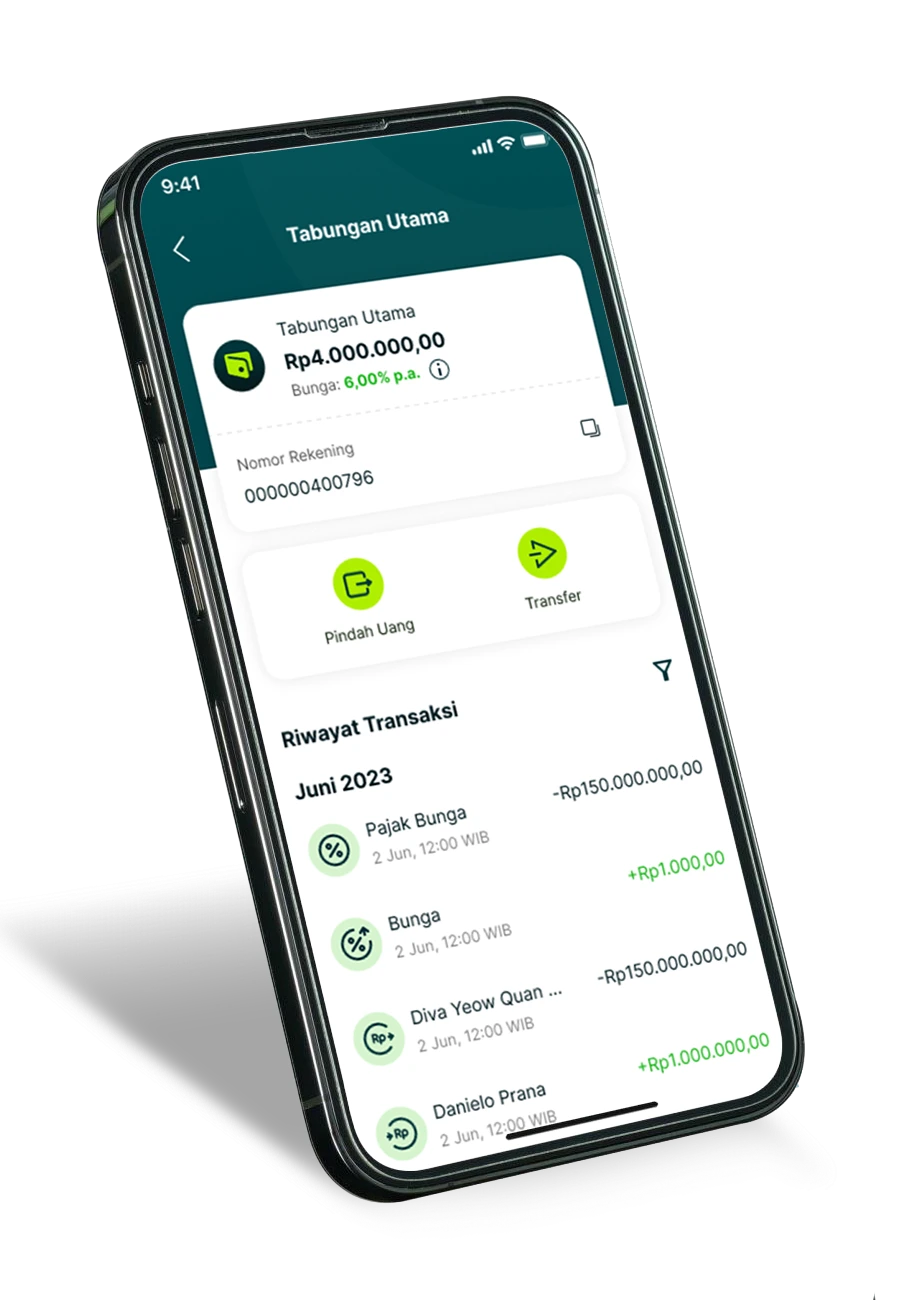

1. Interest Rate

| Main Savings Interest Rate (%p.a) |

|---|

| 6% |